California:

Hayward:

NEW!

7150 Patterson Pass A&B: 181,458 sq ft

1619 Whipple Road: 40,200 sq ft

7600 Hawthorne Avenue: 75,451 sq ft

Fremont:

41707 Christy: 190,080 sq ft

41049 Boyce Road: 47,703 sq ft

44951/31 Industrial: 66,500 sq ft

40577-C Albrae: 43,230 sq ft

40577-B Albrae: 28,260 sq ft

40577-A Albrae: 28,800 sq ft

1619 Whipple Road, 40,200 sq ft

31775 Hayman Street: 75,328 sq ft

2701 W Winton: 237,400 sq ft

Livermore:

7150 Patterson Pass A&B: 181,458 sq ft

7600 Hawthorne Avenue: 75,451 sq ft

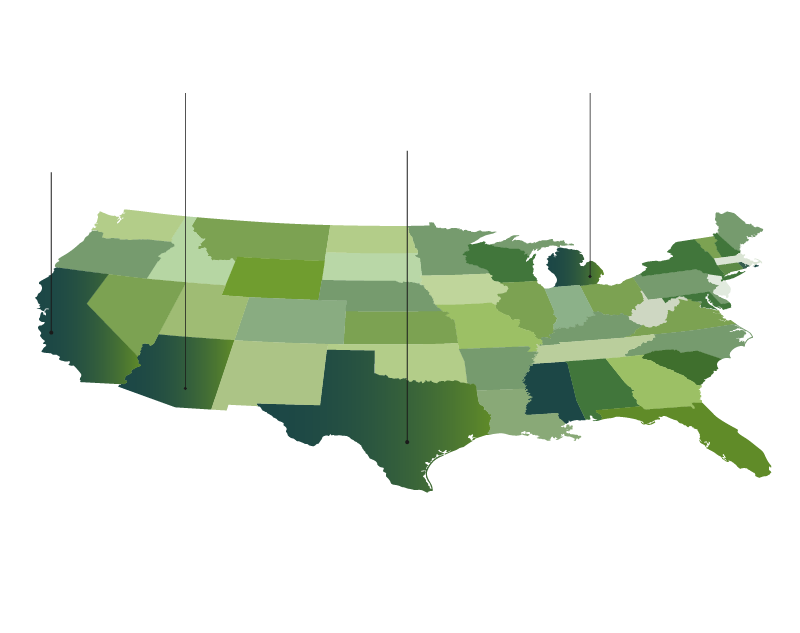

New! Greater Phoenix and Southern Arizona

- Regional sales headquarters

- New 190,000 sq. ft. warehouse planned

New! Austin, Texas

- 200,000 sq. ft. warehousing & distribution center planned

- Supports local automotive plants

- Regional office: 400 Vista Ridge Drive: 111,806 sq ft

New! Ann Arbor, Michigan

- Commercial logistics facility to support KLA

9257 East M-36 (10631 Hi- Tech Dr): 52,800 sq ft

RK is expanding to 4 new locations

With our 4 latest warehouse openings, we’ve increased our footprint to 16 facilities with over 1.6 million square feet of warehouse space.